All Categories

Featured

Table of Contents

Like several various other crowdfunding websites, FNRP hosts a real-time webinar before each bargain launch. In them, a firm board strolls with the deal information and responses any kind of questions to help investors much better understand the financial investment. From there, financiers obtain access to asset efficiency reports, lease updates, and various other asset-specific info, including on mobile applications for Android and Apple.

The firm additionally helps financiers execute 1031 exchanges to delay paying resources gains taxes. Individuals can call FNRP by means of an on-line get in touch with kind or a website-listed phone number. On its web site, FNRP says it's distributed $100 million to investors because 2015, gaining a web IRR of 15%. It likewise specifies that it has more than $2 billion in properties under administration.

Customer solution is readily available from 9 am 6 pm ET. EquityMultiple flaunts a breadth of offerings among 167 distinctive markets and 123 sponsor/operator companions. The company has actually deployed over $570M in investor resources and $379M in overall circulations - Accredited Investor Property Investment Opportunities. EquityMultiple is a terrific choice for investors seeking accessibility to equity, favored equity, and senior financial obligation across lots of CRE home kinds.

Expanding its scope, Yieldstreet has diversified into numerous financial investment avenues, incorporating financing for industrial and household property deals, industrial financings like merchant cash money developments, procurement of oil tankers, and financial investment in art. Financiers obtain interest repayments and the return of their major investment throughout the funding duration. Many opportunities have financial investment minimums in between $10,000 and $20,000, with target hold durations differing by offering.

What should I know before investing in Real Estate Crowdfunding For Accredited Investors?

While most financial investments are offered only to recognized investors, the Growth & Income REIT and the Yieldstreet Alternative Income Fund are additionally offered to non-accredited financiers, with both having a financial investment minimum of $10,000. The Yieldstreet Alternative Revenue Fund invests in numerous different possession courses with a single investment, while the REIT supplies access to a diversified mix of property investments.

One special feature of Yieldstreet is its Purse product, an FDIC-insured checking account that makes 3.25% annual passion on funds held. Financiers can pre-fund their account prior to investing, and the funds will certainly be held within this interest-bearing checking account. The company site has a chatbot for asking FAQs or sending messages, a get in touch with e-mail address, and a Help.

These financiers have added more than $3.9 billion to Yieldstreet offerings. Yieldstreet has a track record of over $2.4 billion of complete dollars returned to investors, with 85% of offerings having actually accomplished within 0.5% of their target. The platform offers eye-catching tax obligation advantages for genuine estate investors.

Its internet site states the platform has sold over $2.1 B in protections across greater than 1.5 K exchange purchases. As of this writing, the system additionally has over 70 energetic financial investment opportunities provided. Unlike other crowdfunding platforms that make use of LLCs, a lot of 1031 Crowdfunding bargains are housed within a Delaware Statutory Count On (DST), which allows fractional possession in buildings and the deferment of capital gains taxes after property sales.

The majority of deals are open to certified investors only. Nonetheless, some REITs and basic real estate funds are open to non-accredited capitalists. Real Estate Syndication for Accredited Investors. Registered individuals can log right into the on-line 1031 Crowdfunding portal to track essential efficiency metrics and accessibility essential financial investment documents such as building PPMs, tax point of views, financial forecasts, assessments, and finance information

What is a simple explanation of Private Real Estate Deals For Accredited Investors?

For aid, users can submit a contact form on the firm's internet site or call the provided telephone number. Overall, 1031 Crowdfunding is a great choice for capitalists that desire to minimize their tax obligation worry with 1031 exchanges and DSTs. There's no one-size-fits-all property crowdfunding system. The appropriate selection will certainly depend upon the sorts of possessions, financial investments, returns, and earnings regularity you want.

Actual estate crowdfunding is here to say. According to Vantage Market Research, the global property crowdfunding market was valued at $11.5 billion in 2022 and is projected to get to a value of $161 billion by 2030, registering a substance annual growth price (CAGR) of 45.9% between 2023 and 2030.

We examined the kind of financial investment, consisting of residential property type, holding periods, and withdrawal terms. We confirmed the minimal amount needed to spend for the platform (Accredited Investor Real Estate Investment Groups). We weighed what charges are connected with spending on the platform, including sourcing, monitoring, and other costs. We examined how simple it is to track a financial investment's performance on the platform.

These referrals are based upon our direct experience with these firms and are recommended for their efficiency and efficiency. We advise only acquiring products that you believe will certainly help in reaching your company goals and investment objectives. Absolutely nothing in this message should be pertained to as investment guidance, either in support of a particular security or relating to a general investment strategy, a suggestion, an offer to market, or a solicitation of or an offer to purchase any type of protection.

What types of Real Estate Investment Networks For Accredited Investors investments are available?

For any type of concerns or support with these sources, do not hesitate to contact. We're here to aid!.

Genuine estate is an effective and potentially profitable method to branch out a financial investment profile. The ideal actual estate investment apps have actually changed that and opened up new opportunities.

The only drawback is that you require to be approved to gain access to a lot of the cooler stuff. Read more $10,000 Development and Earnings REIT and YieldStreet Prism Fund; Varies for various other investments0 2.5% annual administration costs; Added charges differ by investmentREITs, funds, property, art, and other different investmentsVaries by investment DiversyFund offers day-to-day financiers an opportunity to get an item of the multifamily residential or commercial property pie.

You can still go with the old-school method if you want, however it's no more the only method to go. A number of applications and services have actually emerged recently that promise to equalize access to realty investing, providing even small-time financiers the possibility to acquire into and benefit off of huge residential or commercial properties.

What is the most popular Commercial Real Estate For Accredited Investors option in 2024?

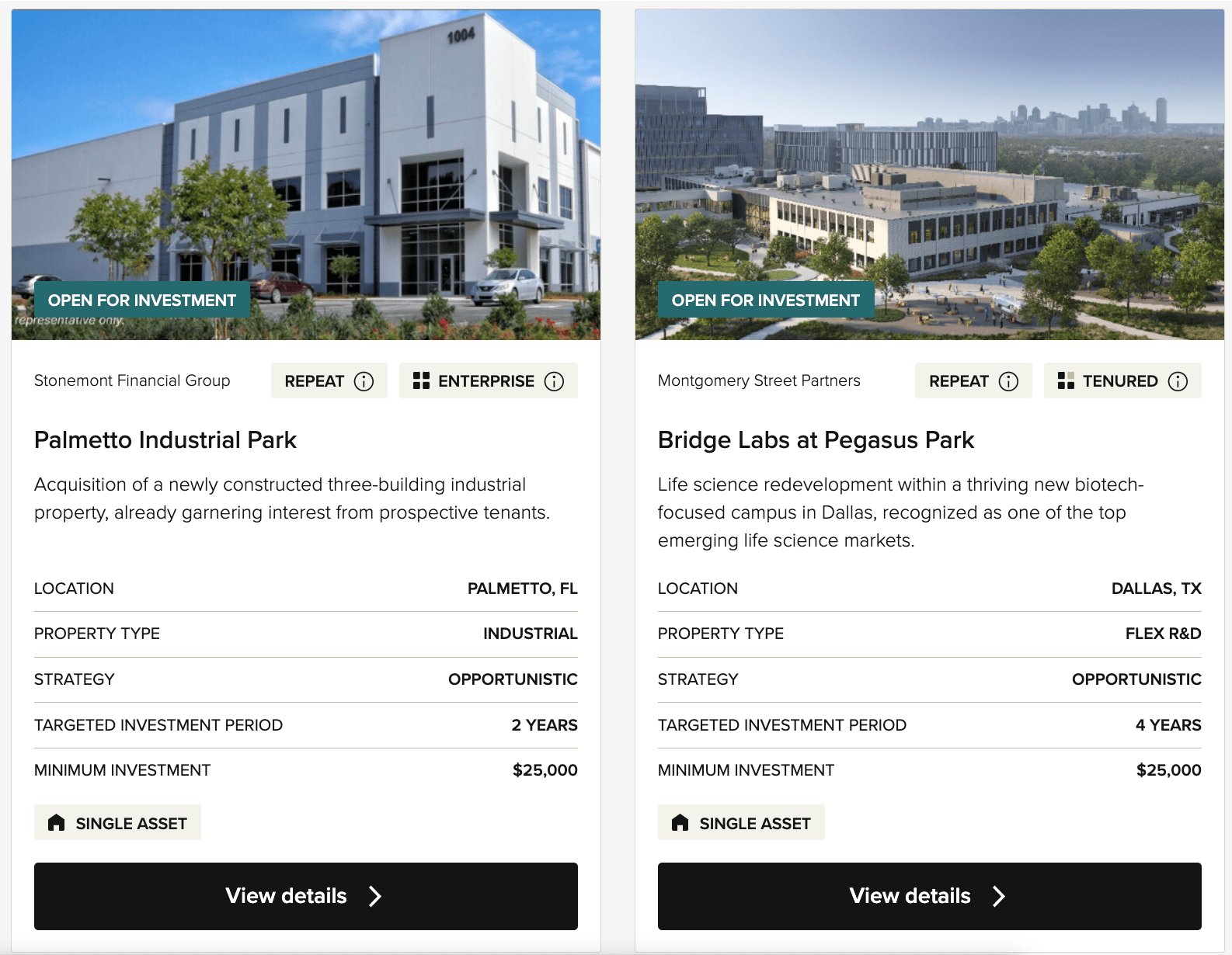

And if not, there are still some opportunities below for you. CrowdStreet expenses itself as the leading on-line commercial realty investing platform. They serve as a kind of business property matchmaking solution that connects certified investors to sponsors looking for capital. There normally aren't that several deals offered on their industry at any type of given time (though this depends greatly on the general property market), however in a manner, that's sort of an excellent point.

Simply put, they aren't scared to reject deals that they do not think are great sufficient for their users. The platform is free, easy to use, and takes a great deal of the migraine out of industrial real estate investing, it isn't best. There are 2 main drawbacks: the rather significant minimal financial investment of $25,000 and the truth that it's limited to certified capitalists.

Latest Posts

Delinquent Tax

Unpaid Property Taxes Near Me

Unpaid Taxes On Homes For Sale