All Categories

Featured

Table of Contents

The auctions are kept in a physical setup or online, and financiers can either bid down on the rates of interest on the lien or bid up a costs they will certainly spend for it. The capitalist that approves the least expensive interest rate or pays the greatest costs is awarded the lien.

Buyers of buildings with tax obligation liens need to be knowledgeable about the expense of repair work together with any various other surprise prices that they may deal with if they presume possession of the residential or commercial property. The brand-new proprietors of these residential properties may have additional legal hurdles, perhaps consisting of the demand to force out the present occupants with the aid of a lawyer, a building supervisor, the local cops, or all three.

Real Estate Tax Lien Investments For Tax Advantaged Returns

The city or area treasurer's office will understand when and where the following public auction will be held. The treasurer's workplace will certainly likewise know where financiers can find a checklist of residential property liens that are arranged to be auctioned and the rules for exactly how the sale will certainly be performed. These rules will outline any preregistration requirements, approved techniques of payment, and other relevant details.

In some instances, the current value of the residential property can be much less than the amount of the lien. Financiers can assess threat by dividing the face amount of the delinquent tax lien by the market value of the property. Higher proportion estimations indicate higher threat. It is essential to look for other liens on the building that will certainly prevent the prospective buyer from taking ownership of it.

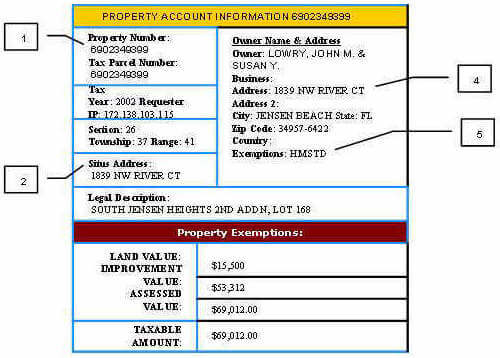

Purchasers can look for these liens by number to get details regarding them from the area, which can commonly be done online. For each and every number, the county has the residential or commercial property address, the name of the proprietor, the evaluated value of the property, the lawful description, and a break down of the problem of the residential property and any frameworks located on it.

About 98% of house owners redeem the residential or commercial property prior to the foreclosure procedure begins. There are about 2,500 jurisdictions cities, townships, or regions that market public tax obligation debt. Investors that are interested in situating tax lien investing chances should contact the regional tax obligation profits official accountable for the collection of residential or commercial property taxes.

Property tax obligation sales are required to be advertised before the sale - tax lien investing tips. Typically, the advertisements list the owner of the building, the lawful description, and the quantity of delinquent tax obligations to be sold. The residential or commercial property proprietor have to settle the capitalist the whole amount of the lien plus interest, which varies from one state to an additional yet is usually in between 10% and 12%

Tax Lien Investing Scam

The payment timetable typically lasts anywhere from six months to 3 years. In the substantial bulk of instances, the owner has the ability to pay the lien in complete. If the owner can not pay the lien by the target date, the capitalist has the authority to seize on the home simply as the district would certainly have.

Investors require to become really acquainted with the real home upon which the lien has actually been positioned. This can assist them ensure that they will be able to collect the cash from the proprietor. A worn out or abandoned home located in a rundown area is most likely not a great buy, despite the assured rate of interest.

Residences with any kind of environmental damage, like harmful product down payments, are likewise undesirable. Lien proprietors need to recognize what their obligations are after they get their certifications. Typically, they should inform the homeowner handwritten of their acquisition within a mentioned quantity of time. They are normally required to send out a 2nd letter of notice to them near completion of the redemption period if payment has not been made completely by that time.

Roughly 80% of tax lien certifications are offered to NTLA participants. Members can get involved in member-only webinars, gain a Qualified Tax obligation Lien Specialist qualification, and utilize the organization's on the internet directory site to link with various other industry professionals.

Tax liens are normally not appropriate for investors that have little experience in or expertise of genuine estate. Capitalists are encouraged not to acquire liens for buildings with environmental damages, such as former gas station websites where dangerous material was discarded. Tax liens are not eternal tools. Numerous have an expiration date after completion of the redemption period.

Tax Lien Investing Nj

If the residential property goes into repossession, the lienholder might uncover various other liens on the residential property, which can make it impossible to obtain the title. Many business institutions, such as banks and hedge funds, have actually become interested in property liens. They've been able to outbid the competition and drive down yields.

However, there are likewise some funds now readily available that buy liens, and this can be a good way for an amateur investor to break into this field with a reduced level of threat. Financiers that buy tax liens seldom seize possession of the residential or commercial property - invest in tax lien certificates. The lien holder and the residential or commercial property proprietor reach an agreement on a schedule for settlement of the amount due plus rate of interest.

Is Tax Lien Investing A Good Idea

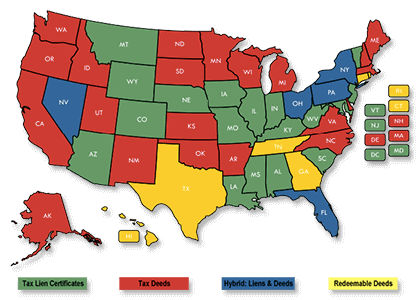

Twenty-nine states, plus Washington, DC, the Virgin Islands, and Puerto Rico, enable tax lien sales. Every state makes use of a somewhat various procedure to execute its tax obligation lien sales. Normally, after a homeowner disregards to pay their tax obligations, there is a waiting period. Some states wait a few months while other states wait a couple of years prior to a tax obligation collector interferes.

When the lien has actually been transferred to the financier, the property owner owes the financier the unsettled real estate tax plus passion. You can call your region's tax collection agency straight to figure out the procedure for buying tax liens. Some areas advertise the days and the procedure on their sites. When regions list auctions on their sites, they will give info about the residential or commercial properties up for public auction and the minimal bids for each residential property.

Property owners with delinquent taxes usually likewise have superior home mortgage financial obligation. After purchasing a tax-foreclosed residential or commercial property, if you discover that there is a home loan lien on it, it must be removed by the region in which you got it. The area will certainly discharge the lien based upon the tax obligation sale shutting documents.

In every state, after the sale of a tax obligation lien, there is a redemption period during which the owner of the building can attempt to redeem the home by paying the delinquent residential or commercial property taxes. Also if the owner is paying their residential or commercial property taxes, the mortgage holder can foreclose on the home if the mortgage is overdue.

This is a public document and acts as a sharp to various other creditors that the IRS is asserting a secured claim versus your assets. Credit reporting companies may find the notification and include it in your credit scores record. Residential property tax liens can be a sensible financial investment alternative for experienced capitalists aware of the property market.

Table of Contents

Latest Posts

Delinquent Tax

Unpaid Property Taxes Near Me

Unpaid Taxes On Homes For Sale

More

Latest Posts

Delinquent Tax

Unpaid Property Taxes Near Me

Unpaid Taxes On Homes For Sale