All Categories

Featured

Table of Contents

Play the waiting video game up until the home has actually been seized by the area and marketed and the tax obligation sale.

Seeking excess earnings offers some benefits and drawbacks as an organization. Take into consideration these prior to you add this approach to your actual estate investing repertoire. This strategy requires very little effort on the selling side. If selling is something you absolutely despise, this might influence your decision. There can be some HUGE upside potential if and when the stars straighten in your favorthey seriously require to in order to accomplish the most effective feasible result - learn overages today.

There is the opportunity that you will gain absolutely nothing ultimately. You might lose not just your money (which with any luck won't be significantly), yet you'll likewise shed your time also (which, in my mind, deserves a whole lot much more). Waiting to accumulate on tax sale overages calls for a great deal of resting, waiting, and expecting outcomes that normally have a 50/50 chance (on standard) of panning out positively.

Accumulating excess proceeds isn't something you can do in all 50 states. If you've currently obtained a property that you intend to "roll the dice" on with this technique, you would certainly better hope it's not in the wrong component of the country. I'll be honestI have not spent a great deal of time meddling this location of investing since I can not deal with the mind-numbingly sluggish rate and the full absence of control over the procedure.

If this seems like an organization possibility you intend to study (or a minimum of find out more regarding), I understand of one man who has actually created a full-on training course around this certain kind of system. His name is and he has actually discovered this realm in great information. I have actually been via a number of his training courses in the past and have actually discovered his techniques to be highly reliable and genuine profitable strategies that function very well.

Unclaimed Surplus Funds

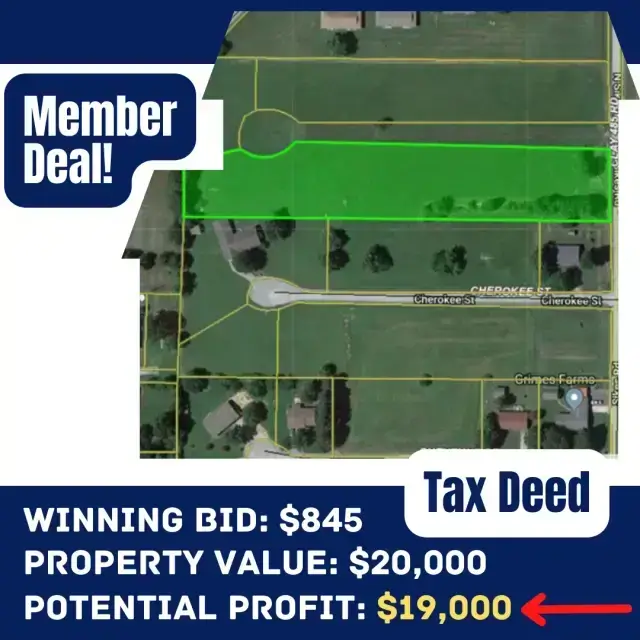

Tax obligation liens and tax acts often sell for more than the county's asking cost at public auctions. Additionally, many states have regulations impacting bids that exceed the opening bid. Repayments over the county's benchmark are known as tax obligation sale excess and can be rewarding investments. Nonetheless, the details on overages can develop problems if you aren't familiar with them.

In this short article we inform you how to get checklists of tax overages and generate income on these assets. Tax obligation sale overages, likewise referred to as excess funds or superior quotes, are the quantities quote over the starting price at a tax auction. The term refers to the bucks the financier spends when bidding process over the opening proposal.

The $40,000 rise over the initial bid is the tax obligation sale excess. Declaring tax sale excess suggests getting the excess money paid throughout an auction.

That stated, tax obligation sale overage cases have shared qualities across many states. During this duration, previous owners and home loan holders can speak to the area and receive the excess.

If the duration expires prior to any kind of interested parties claim the tax sale overage, the region or state typically soaks up the funds. Past owners are on a stringent timeline to case excess on their residential or commercial properties.

National Tax Sale Directory

Keep in mind, your state laws influence tax sale excess, so your state could not allow investors to accumulate overage interest, such as Colorado. In states like Texas and Georgia, you'll make rate of interest on your entire bid. While this element does not imply you can claim the overage, it does aid mitigate your expenditures when you bid high.

Keep in mind, it could not be lawful in your state, meaning you're restricted to gathering passion on the excess. As specified above, a capitalist can find means to make money from tax sale excess. Due to the fact that rate of interest revenue can put on your entire bid and past proprietors can claim excess, you can leverage your knowledge and tools in these circumstances to optimize returns.

Initially, similar to any type of investment, research is the essential opening action. Your due persistance will provide the essential understanding into the residential properties readily available at the following auction. Whether you use Tax obligation Sale Resources for investment information or contact your area for info, a comprehensive examination of each residential or commercial property lets you see which residential properties fit your investment design. A crucial aspect to keep in mind with tax sale excess is that in most states, you only require to pay the area 20% of your overall quote up front., have regulations that go beyond this policy, so once again, research your state regulations.

Instead, you just need 20% of the bid. If the property does not retrieve at the end of the redemption duration, you'll need the continuing to be 80% to get the tax obligation action. Because you pay 20% of your quote, you can earn passion on an overage without paying the complete rate.

Once again, if it's lawful in your state and area, you can work with them to aid them recoup overage funds for an additional charge. You can collect rate of interest on an overage quote and bill a fee to simplify the overage claim process for the previous proprietor. Tax Sale Resources lately launched a tax sale overages item especially for individuals curious about going after the overage collection company. tax lien lists free.

Overage collectors can filter by state, region, residential or commercial property type, minimum overage quantity, and maximum excess amount. When the information has actually been filteringed system the enthusiasts can choose if they intend to include the skip traced information package to their leads, and afterwards pay for only the confirmed leads that were discovered.

Tax Sale Attorney Com Legit

In enhancement, just like any other financial investment strategy, it uses one-of-a-kind pros and disadvantages.

Tax obligation sale overages can form the basis of your financial investment version since they supply an economical way to earn money (foreclosure overages business). You do not have to bid on buildings at public auction to invest in tax sale overages.

Instead, your research, which may involve skip tracing, would cost a somewhat little fee.

Your sources and approach will establish the ideal environment for tax obligation overage investing. That stated, one technique to take is collecting rate of interest on high costs.

Furthermore, excess relate to even more than tax obligation acts. So, any kind of public auction or foreclosure involving excess funds is an investment chance. On the other side, the main disadvantage is that you may not be awarded for your effort. You can spend hours investigating the previous proprietor of a property with excess funds and contact them only to uncover that they aren't interested in going after the money.

Table of Contents

Latest Posts

Delinquent Tax

Unpaid Property Taxes Near Me

Unpaid Taxes On Homes For Sale

More

Latest Posts

Delinquent Tax

Unpaid Property Taxes Near Me

Unpaid Taxes On Homes For Sale